New York Times Best Selling Author of In This Economy?

Making complex economic ideas clear, relatable, and meaningful.

NY Times Opinion

Wall Street Journal

Foreign Policy

Bloomberg

Vanderbilt Policy Accelerator Fellow

1M+ Followers

Barron's Top 100 Women in Finance 2025

The Daily Show

Ezra Klein

NY Times Opinion Wall Street Journal Foreign Policy Bloomberg Vanderbilt Policy Accelerator Fellow 1M+ Followers Barron's Top 100 Women in Finance 2025 The Daily Show Ezra Klein

About Kyla

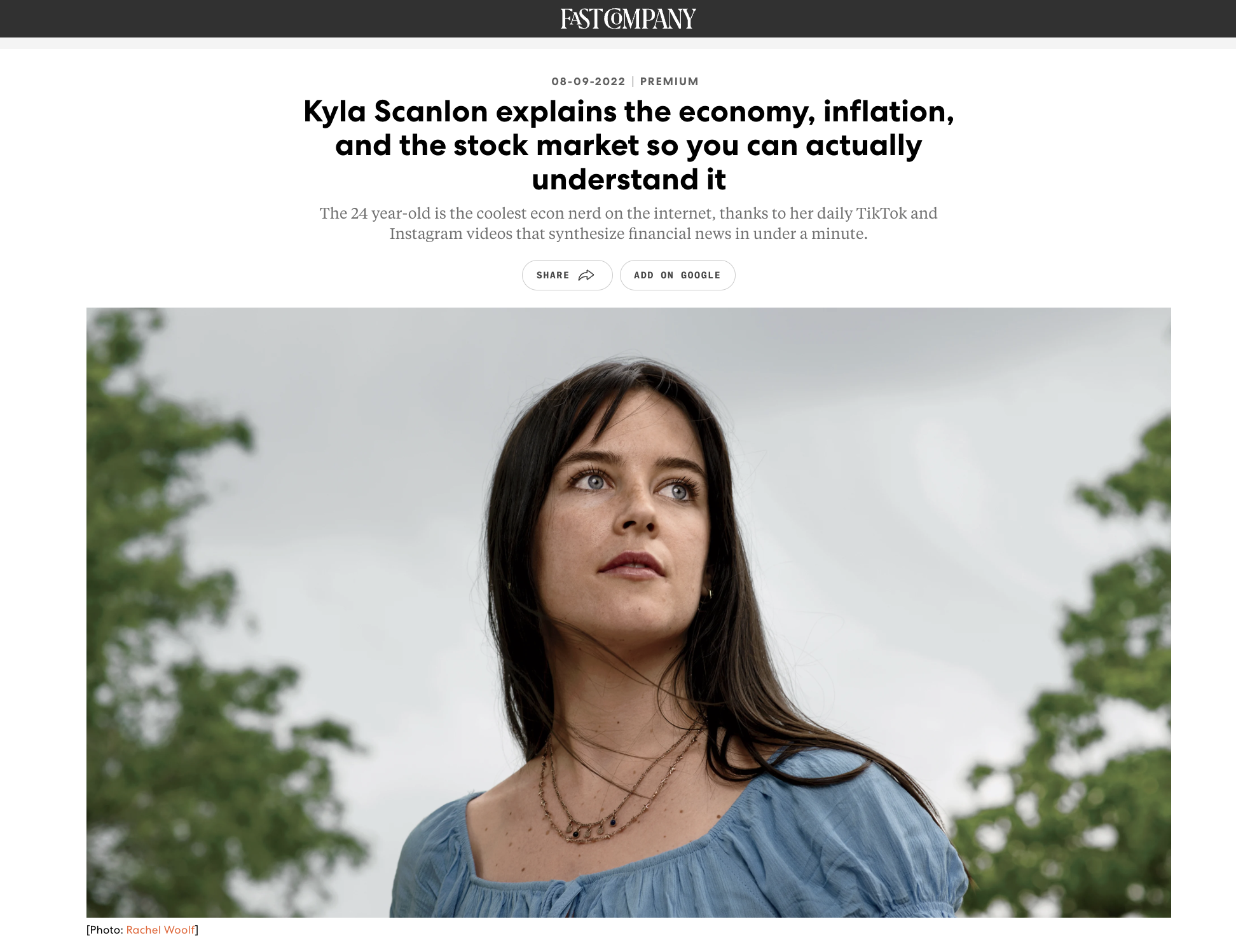

Kyla Scanlon is an economic commentator, speaker, educator, author, and creator.

With more than one million followers across platforms, including TikTok, YouTube, Instagram and Substack, Scanlon educates and inspires a new generation by reshaping how people understand money and markets.

Through her signature mix of analysis and storytelling, Scanlon covers the pressing issues of the day - from tariffs and artificial intelligence to the value of higher education and Gen Z’s evolving role in the economy. Her debut book and New York Times bestseller, In This Economy? How Money and Markets Really Work, is where she coined the term “vibecession” to describe the disconnect between strong economic data and negative sentiment.

Raised in Kentucky, Scanlon studied finance, economics, and data analytics at Western Kentucky University. Her first jobs included trading options and selling cars, which is where she saw the opportunity to make finance accessible. During the pandemic, she began using whiteboards and social media skits to decode markets and economic trends for everyday audiences.

Scanlon is now working on her second book, contributes to The New York Times Opinion, The Wall Street Journal, and Foreign Policy, among others, and is a Vanderbilt Policy Accelerator Fellow. She can also be seen regularly on MSNOW and CNN as well as traveling extensively for speaking engagements.

Contact

General Inquiries:

KylaScanlonTeam@unitedtalent.com

Speaking Engagements:

Jennifer.Peykar@unitedtalent.com

Talent Inquiries:

KylaScanlonTeam@unitedtalent.com

Advertising and Brand Engagement:

KylaScanlonTeam@unitedtalent.com