I remember 2008. I was 11. I remember being worried about gas prices. I remember not going on vacation. I remember things being tense. I could feel the stress that surrounded me.

But I still went to school. I still played with my friends. It was all fleeting, more or less.

Now, we are at the cusp of intense uncertainty. I spend a lot of time reading, and I oscillate back and forth between how I should respond to COVID-19.

The world is bi-modal: you have those prepping with three months worth of non-perishables, and then you have those booking cruises.

And truly, I have no value-add to the COVID-19 conversation. I am not an epidemiologist. I am not a virologist. I can summarize what I know and what I think, but that simply wouldn’t be of value to anyone. You can go on Twitter and get the opinions of thousands.

Horns vs. Paws

I also wanted to write about something happy. There has been a lot of sadness recently. 2020 has been a wild ride from the beginning. A town very close to my heart was hit by a tornado last week – Nashville, Tennessee. Friends lost their homes. Friends of friends lost their lives.

It is easy to be pessimistic. We humans love to panic. Sometimes, it is healthy to be aware and alert (like you probably should have 2 weeks worth of goods in the case of quarantine). But sometimes, you really need some happiness.

So, here is the bull case for the bear days.

Training Like an Athlete

When you train, you must take time to rest. This is known as periodization. It’s cyclical: you workout, you workout, you workout, and then you rest. You can’t expect to go into the gym everyday of the week and hit massive personal bests, unless you are on steroids.

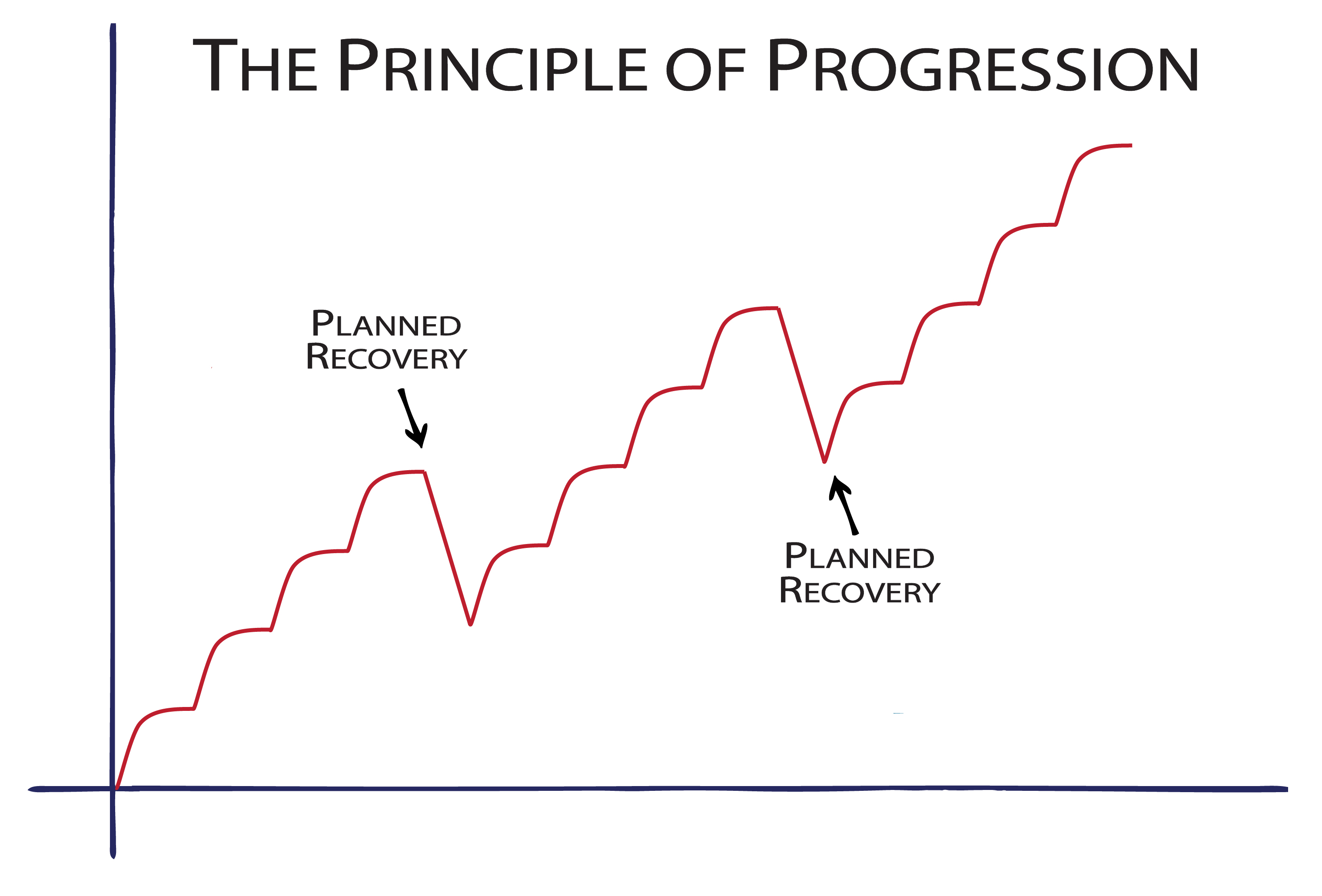

The chart above is how an athlete progresses. Time on the x-axis, strength and performance on the y-axis. As you can see, the progression is interrupted by a microcycle known as “planned recovery”.

However, that “planned recovery” results in an athlete that is stronger than they were previously. They continue progressing and growing, beyond the microcycle. The break made them stronger, gave them time to heal their muscle and mind.

This is not unlike markets.

The market has periodization to it. It takes small breaks, recovers, and pushes back up, objectively speaking.

So, speaking rather simply, athletes taking rest periods is similar to the market experiencing downturns. Athletes also spend a lot of time honing their skills during the downtime.

They spend more time stretching, or perhaps take up yoga or another sport. Runners will spend more time on strength work, more time on hill running, and springing. They innovate.

It’s the same in the markets.

Periodization in Markets

I came across a tweet from Yuri Sagalov, an angel investor.

These companies were founded at the same time of the mobile revolution, which gave them a boost. However, it was still deep in the Recession. At this time, you had to operate lean and mean to survive. You had to innovate. You had to be athletic.

A downturn can create opportunities.

Booz & Company (now acquired by PwC) published an R&D analysis in late 2009. Despite operating income and net income falling 8.6% and 34%, respectively, companies still managed to increase their R&D spending by 5.7% in 2008.

90% of CEOs saw innovation as “critical as they prepare for the upturn”, with Adalio Sanchez, the general manager of IBM’s System X server business, stating, “I would argue that the recession is a catalyst for increased innovation“.

More than 550k new businesses launched in 2009.

Richard Florida, senior editor at the Atlantic, said it well:

Economic crises like the current one (The Great Recession) have devastating economic and social costs, but they also give rise to major rounds of technological innovation. That’s why I call them Great Resets.

Source: The Atlantic

This also falls under the umbrella of Joseph Schumpeter’s creative destruction: “the process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one“.

The world is dynamic, constantly moving and breathing. It sometimes takes a wave to wipe the slate clean, making way for improvements, innovations, and efficiencies.

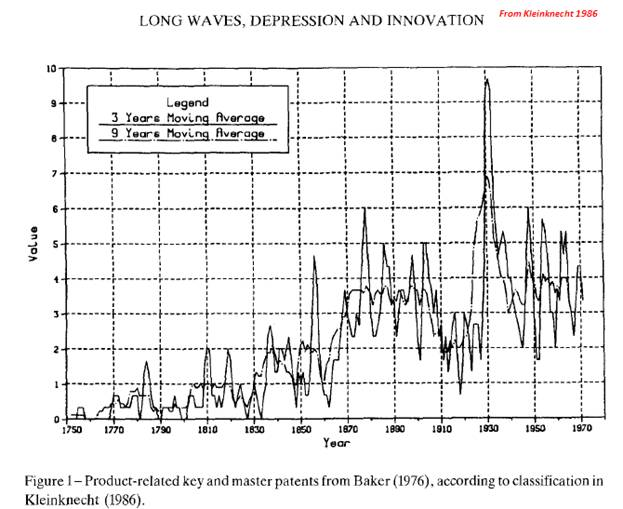

This is a graph from Alfred Kleinknecht, via The Atlantic. There are spikes in patent activity after the Depression of the 1870s -1880s and the Great Depression.

Source: The Atlantic

Alexander Field described the time following the Great Depression as the “most technologically progressive decade of the 20th century for the U.S.” WWII helped to boost growth, but as researchers Bakker, Crafts, and Woltjer found, “it was not required to rescue the economy from low trend growth.”

The table above depicts the sources of labor productivity growth in the US from growth accounting estimates. Total factor productivity (TFP) growth was very strong in the 1920s and the 1930s, measured by dividing economy-wide total production by the weighted average of inputs, such as labor and capital.

A 2010 article in the Harvard Business Review conducted a similar analysis and found that the companies that “reduce costs selectively by focusing more on operational efficiency than their rivals do, even as they invest relatively comprehensively in the future by spending on marketing, R&D, and new assets” is the “best antidote to a recession“.

A company can’t focus solely on cost-cutting, like Sony did in 2008. A prevention-focused approach, leads companies to do “more of the same with less“. Survival instincts kick in and innovation goes to the curb. The authors found that the companies that focused on cutting costs trailed peers growth “by 6% in sales and 4% in profits, compared to 13% and 12% for progressive companies“.

However, a company also shouldn’t be too aggressive. The authors highlight Hewlett-Packard’s 2000 change agenda which resulted in overspending and overstretched management, in the author’s opinions. These companies tend to have rose-colored glasses on, thinking that the most extreme of innovation and M&A will push them through. However, according to the authors, they don’t respond to customer needs or wants, and that negatively impacts results.

There must exist a combination of both strategies. This results in a decision matrix, in which companies must choose the approach to take. This results in a “progressive enterprise”, one that “cut costs mainly by improving operational efficiency… and develop new business opportunity by making greater investments than their rivals do in R&D and marketing.”

Paying attention to customer needs was a guiding light in many of the companies that survived and prospered following the Recession. Companies focused more on product development and engineering, and the downturn encouraged them to speed up their innovative efforts.

Sanchez again:

“When you’re in a situation where you’ve really got to be judicious, to do more with less, that really drives a need for innovation and a level of creativity that you might not otherwise have in normal times. Increased innovation doesn’t always have to be about more dollars. It’s about how you use those dollars and how you accelerate some products just to bring them out.”

Source: Strategy Business

Innovation isn’t just about spending. It’s about creatively allocating those dollars to products and ideas to generate true output.

Just like you can’t become a better runner by running endless miles: you have to stretch, do preventative maintenance, and strengthen as a total athlete. Same with innovation – nothing is truly linear.

Recessions are Resets

So, cycles maybe aren’t that bad. I don’t know. But it does create the opportunity to recreate and reset.

The recovery portion of the training curve is never easy. I remember in my college track days how painful the down weeks were. I just wanted to RUN. Even now, in my yoga-lifting-running cycle, the weeks that are recovery weeks can be disruptive, simply from the mental shift from ‘go-go-go’ to ‘slow-slow-slow’.

But we grow when we rest. Muscles under constant tension will never grow to their full potential (hello, over-training).

Rest can sometimes be challenging. But it can also be good. It all depends on how you look at it.

Disclaimer: None of this is investment advice. The analysis written is my own, and does not represent the views of my employer. This is an article written about a sensitive topic, and it is my attempt to shed light on a potential positive side of that. All of the research is from outside experts, and their views are their own.

Leave a comment